Three and Vodafone customers will benefit from increased coverage and 5G speeds - if merger approved

Opensignal, an independent analytics company that measures the experience of mobile phone networks, has predicted that the proposed Three and Vodafone merger will create a new network that will rival O2 for overall coverage and compete with EE for 5G coverage, benefiting customers of both networks.

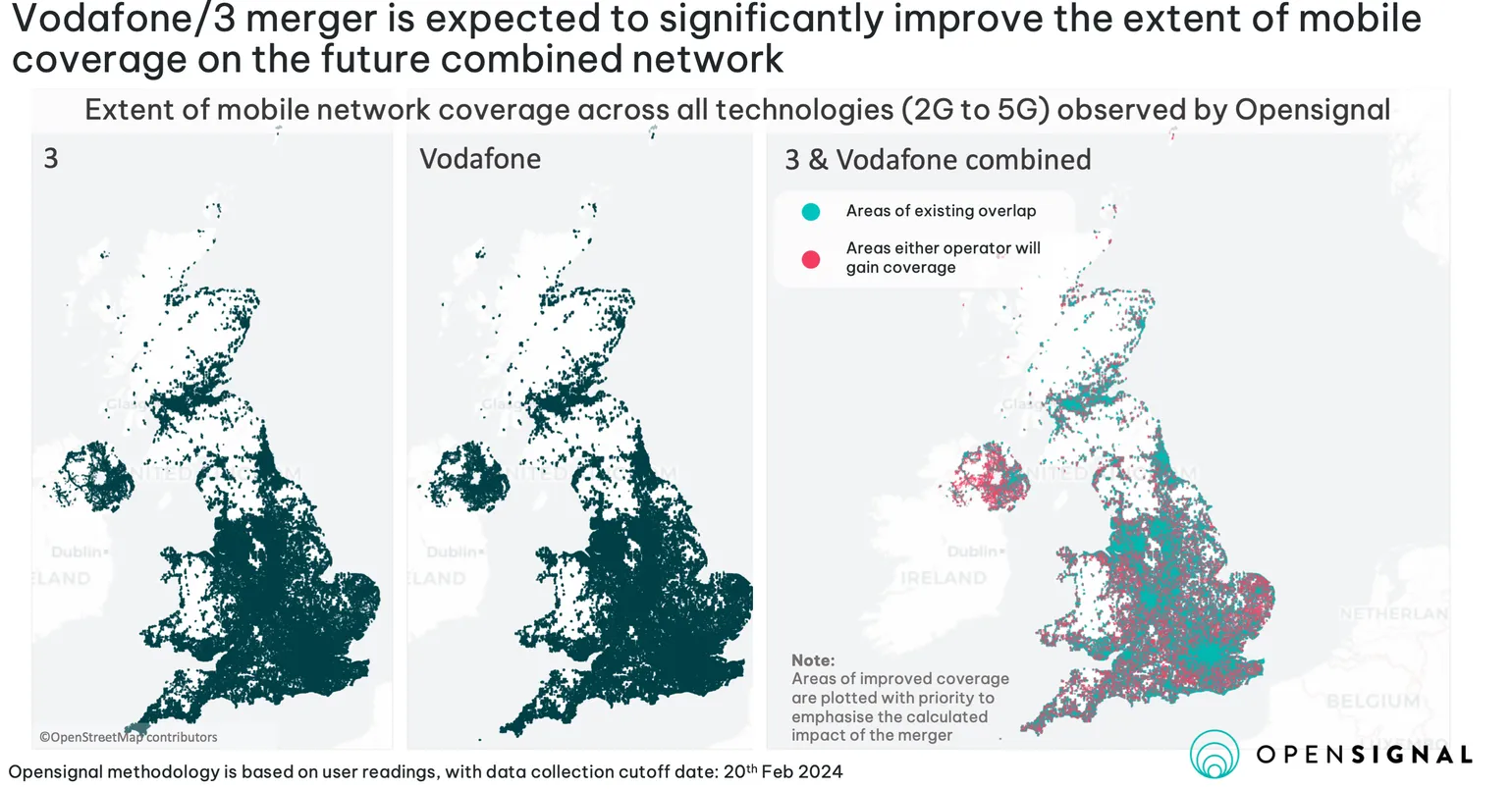

In terms of coverage, signal strength and speeds, both Three and Vodafone will gain advantages from the merger, particularly in more rural and sparsely populated areas.

Opensignal’s Coverage Experience metric currently rates Three with 7.6 points and Vodafone with 8.2 points, based on a maximum of 10 points. O2 is currently in first place with 8.8 points, and EE is in second place with 8.5 points, meaning Vodafone and Three are at the bottom of the table, respectively.

However, the combined network will bring the new score to 8.8 points, joining O2 in first place. The result will be a 16% increase for Three customers, and an 8% increase for Vodafone customers. This assumes existing infrastructure and sites for both networks will continue to operate as normal if the merger is approved, however this is not guaranteed.

| Network | Coverage Experience points |

|---|---|

| Propsed Vodafone and Three merger | 8.8 |

| O2 | 8.8 |

| EE | 8.5 |

| Vodafone | 8.2 |

| Three | 7.6 |

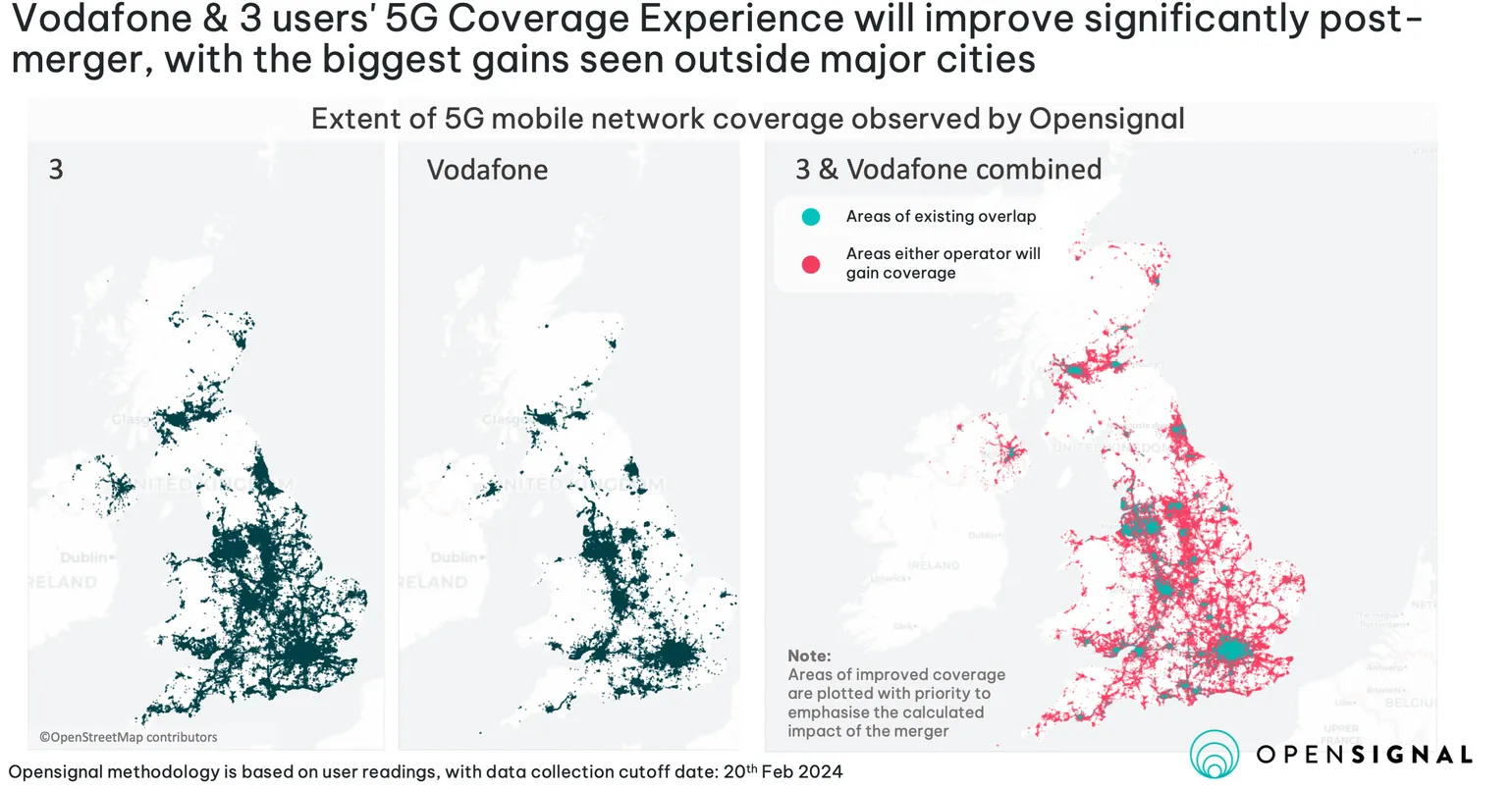

Three and Vodafone customers will also benefit from increased 5G coverage and performance, in particular for Vodafone customers.

The map below shows Vodafone’s 5G presence in rural areas is particularly poor, and is the worst of the 4 major networks. They do, however, have a formidable presence in major towns and cities across the UK, which competes fairly well.

On the other hand, Three more or less matches Vodafone’s 5G coverage in major towns and cities, but also expands further into rural and less densely populated areas.

Currently, EE is in first place for 5G Coverage Experience, with 3.8 points. Three follows in second place with 3.3 points, followed by O2 with 2.8 points, and Vodafone in last place with 1.8 points.

If Three and Vodafone were to merge, the combined network will score 3.6 points. While Three customers will only see a 9% increase in 5G Coverage Experience, Vodafone customers will see a whopping 106% increase.

The proposed new network will just be slightly behind EE in first place, who have 3.8 points for 5G Coverage Experience. However, as the difference is tiny, 5G performance between the two networks will basically be negligible, meaning EE will finally have a competitor in this regard.

Voafone is currently the 3rd largest network in the UK, with 18.6 million customers. On the other hand, Three has the fewest customers of the 4 major networks, with 9.4 million connections. The combination of both networks will be the largest in the UK, with a 32% market share, dethorning EE who are currently in first place with an approximate 23% market share.

This will be a particular concern for regulators. The new network could potentially become a monopoly, driving up prices for consumers and leading to less competition. However, the government will also be aware that the UK significantly lags behind Europe and other countries when it comes to 5G performance. Both Vodafone and Three have argued that a merger will essentially fix this problem, as building 5G infrastructure is very expensive and time consuming for a single entity. Whether that’s enough to sway the decision in favour of a merger is not clear.